Manipulation in accounting is more common in firms where the work culture promotes self-interest, according to a joint study by Australian and Dutch researchers.

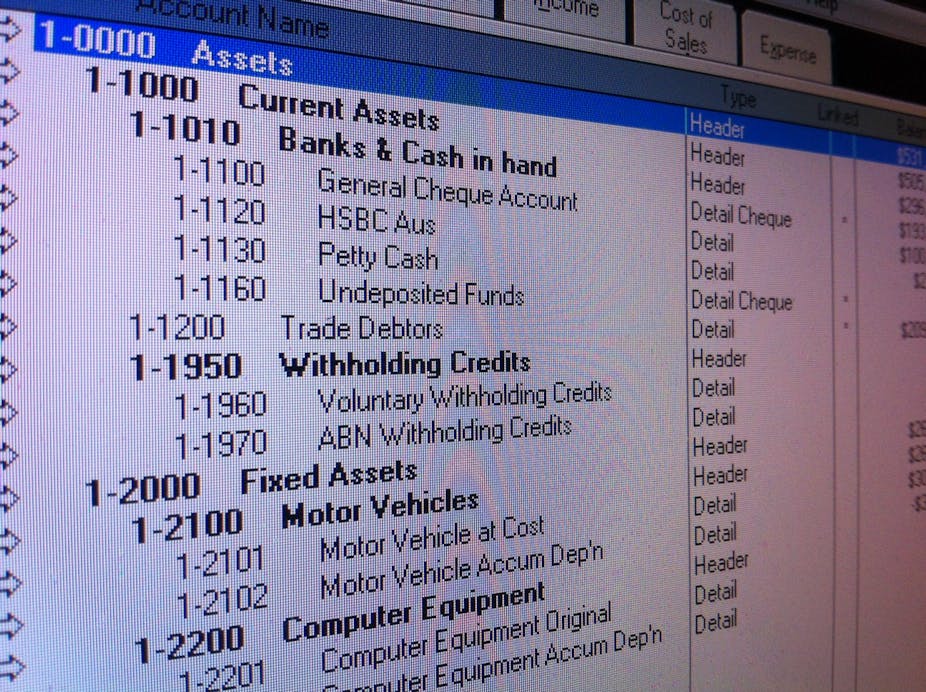

The study, which obtained anonymous responses from 550 mostly male senior managers in The Netherlands, found that manipulations included everything from deferring necessary spending or accelerating sales to shifting funds between accounts to avoid budget overruns.

Where firms embraced a work culture that was focused on “self”, the managers were also likely to be on expensive performance incentive work contracts that encouraged them to consider the impact of their actions on shareholders, investors and colleagues.

The study was carried out by Margaret Abernethy, the Sir Douglas Copland Chair of Commerce in the Faculty of Business and Economics at the University of Melbourne and Jan Bouwens and Laurence van Lent of the CentER and Department of Accountancy at Tilburg University.

While the managers surveyed were based in The Netherlands, Professor Abernethy said that the problem was universal: “There’s no reason to believe that our results are not applicable to managers and those in the accounting and finance professions in Australia or any other developed country.”

Julie Walker, an Associate Professor in Accounting at University of Queensland, agreed that manipulation was “likely just as prevalent in Australia. There’s nothing institutionally different about the two countries that would suggest otherwise.

"This is an important finding because while we can say that accounting manipulation, or earnings management, is common, this study links that behaviour to the culture of the firm rather than simply looking at the economic stimulus for the behaviour - in this case the incentive contract,” said Professor Walker, who was not involved in the study.

“That’s important because it helps us understand when accounting manipulation is most likely to occur and therefore how to mitigate its occurrence.”

Professor Abernethy said changing the ethical work climate of a firm was difficult, but “the type of performance incentive contract could mitigate some of the adverse consequences associated with a focus on self”.

“Our study demonstrates that the ethical work climate of a firm has a strong relationship to incidences of accounting manipulation and to the types of incentive contracts that firms decide to use.”

Professor Bouwens said that the background of the managers was also an important factor in the way they performed their job. All other conditions being equal, managers with a certified-accountant degree background were less likely to manipulate accounts.

“This tells us that with education and training we can significantly affect the likelihood of people resorting to unethical behaviour. During these programs accountants learn that it is always in their best interest not to cross the line.”

The study had implications for Boards of Management concerned with ensuring firms embedded cultural norms that promoted ethical behaviour, Professor Abernethy said. “This is important because we know the tone at the top influences the actions of individuals within the firm.”

Professor Walker said that “getting rid of incentive contracts would simply shift and possibly hide the problem. Many payoffs for senior managers are tied implicitly to firm performance and these can induce earnings management behaviour. For example, there is plenty of evidence that managers manipulate earnings to achieve analyst forecasts and this is a subtly different motivation than that presented by a performance incentive contract - trying to keep the share price up, rather than trying to maximise a performance bonus. In addition, most senior managers performance will be evaluated on the basis of financial performance even if there is no explicit performance linked incentive in place.

"In my view, the solution is what the authors here call the ‘tone at the top’. There is considerable evidence that good governance reduces accounting manipulation because it creates a more open and transparent reporting environment with greater monitoring of manager’s individual actions and performance.”