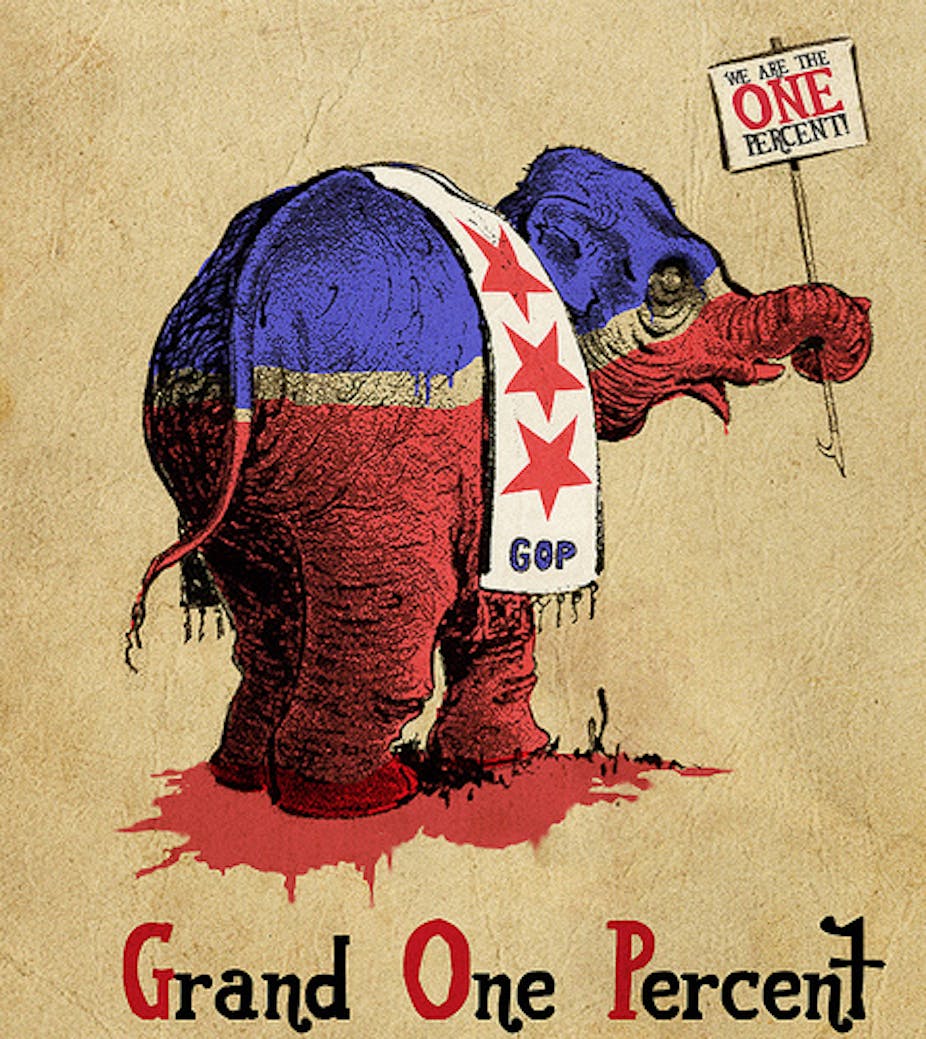

In a widely anticipated forthcoming book, Edward Conard – a former Bain Capital colleague of Mitt Romney’s – has advanced the arguments that investment drives economic growth, and that deregulation and support for the investment class is necessary to revive growth. To be sure, Unintended Consequences: Why Everything You’ve Been Told About the Economy Is Wrong is not an official campaign statement. However, it can arguably be seen as representing the most concerted, sophisticated case for “the 1%” – and it accords with candidate Romney’s view of corporations as “the job creators”.

While the book has not yet been published, Conard has spun out his thesis in a number of interviews, arguing that “most citizens are consumers, not investors” and so “they don’t recognise the benefits to consumers that come from investment”. In this light, Conard can be seen as advancing a longstanding view, rooted in classical economic theory and its variants – from Adam Smith to Karl Marx to contemporary supply-siders – that the strength of an economy resides in its supply of real resources – in its stock of land, labour, and capital. In this view, it is necessary to liberate the investing, job-producing class in order to generate economic growth. Put simply: if government provides appropriate supports, investors will “build better mousetraps” to consumers’ benefit.

Of course, this is not a new argument. It represented the conventional wisdom among economists up until 1935. However, in 1936, John Maynard Keynes published the General Theory of Employment, Interest and Money. Prior to its publication, Keynes confessed to having little time for classical economists like Adam Smith or ostensible radicals like Karl Marx.

Instead, Keynes saw classicals and Marxists as joined at the hip in a view of the “factors of production” as having a self-evident weight. Keynes wrote to one of his contemporaries: “To understand my state of mind … you have to know that I believe I am writing a book on economic theory, which will largely revolutionise … the way the world thinks about economic problems. When my new theory has been duly assimilated and mixed with politics and feelings and passions, I can’t predict what the upshot will be in its effects on actions and affairs. But there will be a great change and, in particular, the Ricardian foundations of Marxism will be knocked away.”

Breaking with Smith and Marx – and their heirs like Romney and Conard – Keynes argued that the supply of resources was meaningless in abstraction from a sense of aggregate demand. In his view, if no demand existed for mousetraps, machinery, or microchips, investors simply would sit on their hands. It would not matter how cheap or abundant capital might be, how plentiful government subsidies might be, or how light the hand of regulation might become. To Keynes, “no customers” meant “no investment”. Instead, it was demand that drove investment, and only in that light that investment might subsequently drive economic growth.

This is why Conard and other supply-siders are also wrong about inequality – which peaked in both the 1920s and the 2000s, in ways that helped to cause both the Great Crash and global financial crisis. In each decade, a lack of purchasing power on the part of the wider public led to a reduction in productive investment by the “1%”.

Instead, investment spun off into successive financial bubbles. In the 1920s, a real estate bubble preceded the stock market boom that culminated in the Great Crash. In the 2000s, the dot-com boom was followed by the subprime boom that gave rise to the GFC.

In this light, calls for further tax cuts for the wealthy, or government austerity – as has been tried and has failed in Europe – are unlikely to be successful in restarting growth. History has its lessons here as well. In the 1930s, the Roosevelt administration recognised that the supply of investment did not create its own demand. Instead, as Roosevelt noted in his inaugural address: “Plenty is at our doorstep, but a generous use of it languishes in the very sight of the supply. Primarily this is because the rulers of the exchange of mankind’s goods have failed, through their own stubbornness and their own incompetence, have admitted their failure, and abdicated. Practices of the unscrupulous money-changers stand indicted in the court of public opinion, rejected by the hearts and minds of men.”

Given this view – which anticipated Keynes – Roosevelt did not seek to simply redistribute wealth, but rather to reform institutions to strengthen the bargaining power of labour and enhance the rights of consumers – in ways that would restart the engines of demand. This meant writing down debts and mortgage values, and permitting increased wage inflation as a means to growth. It meant abolishing the gold standard to restart global demand and enable governments worldwide to cut interest rates (a step with implications for Europe today). Most of all, it meant breaking with a material view of investment as driven by supply-side forces, and recognising instead the importance of demand to the common good.

In this light, Conard should be seen as an ironic Marxist, viewing the economy through the lens of competition over land, labour and capital - and failing to recognise the importance of aggregate demand and “animal spirits” to the overall economy. It is fallacious to suggest the vast accumulation of capital speaks for itself.