The Australian government announced on 10 July it would introduce a carbon tax at $23 a tonne in July 2012, rising 2.5% annually plus inflation and moving to a market-based emissions trading scheme in 2015.

To sweeten the deal, the government has proposed raising the income tax-free threshold to $18,000, as well as other tax cuts and compensation for nine out of 10 households, said Prime Minister Julia Gillard.

The tax will be paid by 500 companies — half the 1000 initially slated for carbon tax eligibility — and agriculture and petrol will be exempt.

The deal will be put before parliament in August and is expected to pass with approval of several independents. It will also pass through the Senate, thanks to the support of the Greens.

We asked our authors to give their perspectives on the proposals. We’ll be adding more stories every day, so keep checking back. Or for all our carbon tax stories since we launched, visit our carbon tax page.

Eva Cox from the University of Technology, Sydney, asks why Australians have become so selfish, and why the main argument about the carbon tax consists of “what’s in it for me?”

Opposition leader Tony Abbott claims the proposed carbon policy is “socialism by stealth”? I wish!

I suspect we do need some emphasis on the common good and public benefits to counter the attempts to sell us a tax change via short-term self interest – but this is not the case.

The whole justification for this package ought to be the future. A package that promises no pain for most of us undermines the possibilities of real political leadership that tweaks of our social conscience. Read more…

Peter Daniels from Griffith University explains why a carbon tax shouldn’t damage Australian trade, and lays out why the alternative would be so much worse.

In the lead up to the carbon price announcement, much of the criticism of the scheme has talked about the damage to Australia’s exports. But the move to price carbon could save us from a far worse economic future.

Australians do not need to believe in global warming to have faith in the benefits of carbon pricing. There is a strong case in favour of such measures for Australia, and they don’t have anything to do with fighting climate change. Read more…

Dylan McConnell and Patrick Hearps from the University of Melbourne take a closer look at the funding for renewable energy, and find a lot to be positive about.

In the lead-up to release of the carbon tax package, the government signaled a desire to end renewable energy support measures and rely solely on a carbon price to transform the Australian energy sector. But the political reality of a minority government has resulted in a raft of additional measures that majority government alone would not have achieved.

The final agreement effected largely by the Greens and Independents includes the creation of several independent bodies to help drive Australia’s shift from climate changing fossil fuels to renewable energy sources, and for giving Australia a real chance at profiting from the coming clean energy technology boom. But they may not be sufficient. Read more…

Peter Whiteford from UNSW pulls apart the household compensation package to see who really benefits, and whether the sums add up.

A major component of the government’s plans for a clean energy future is an assistance package to compensate for higher prices affecting households. The government will increase pensions, allowances and family payments and cut income taxes.

From a political and social perspective, the adequacy of these compensation proposals will be critically important. Read more…

John Passant from the University of Canberra says pricing carbon is unfairly making working people pay for a problem that markets have created.

The carbon tax is short-term carrot and long-term stick. The Coalition’s campaign against “a great big new tax” drove Gillard to introduce a tax for which most people and businesses affected will be compensated.

Some will be overcompensated, at least in the first years of the scheme. But that compensation will prove illusory over time, because the package is designed to soften us up for a future attack on our living standards. Read more…

John Stanley from the Business School at the University of Sydney had hoped the carbon tax would give a boost to public transport. Now the details are out, he finds travellers who rely on buses, in particular, are likely to suffer.

Transport accounts for 14% of Australia’s greenhouse gas (GHG) emissions and has one of the fastest emission growth rates. Cutting our national emissions might, therefore, be expected to shine a blowtorch on transport fuels, right?

Well, partly right. For public transport, the news isn’t good. Read more…

*Miranda Stewart from the Melbourne Law School has pulled apart the package’s tax measures and says it’s heading towards reform, with some serious stumbles on the way. *

At first glance, the Federal Government’s carbon tax plan appears to carry out significant income tax rate reform in the guise of carbon price compensation.

Indeed, the proposed tax rate reforms adopt the essence of recommendations by the 2009 Henry Tax Review of Australia’s Future Tax System.

But it is worth delving into the detail to fully understand how some will benefit more than others – and perhaps not the ones we think. Read more…

Alan Pears from RMIT says if you’re worried about cost of living pain, there may be some simple ways you can reduce the burden of a carbon tax, and maybe even profit from the package.

Will paying a price for carbon dioxide emissions make our lives miserable and destroy the economy? No. In fact, the carbon price could make households and businesses better off if they take a few important steps.

A carbon price is an important response to the climate change challenge. At present, those who dump greenhouse gases (particularly carbon dioxide) into the atmosphere don’t pay for the damage they do, or to help repair that damage. A carbon price creates a price disincentive to keep doing this, while making emission reduction more financially attractive. Read more…

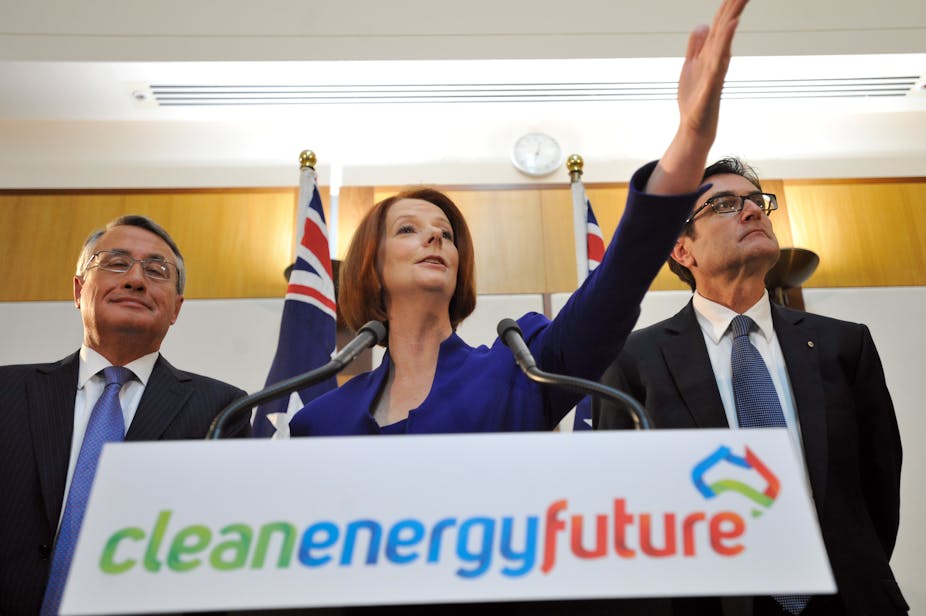

Monash University’s Zareh Ghazarian pulled apart the Prime Minister’s press conference and looked at how the sell might go from here.

It began with the familiar sight of the Prime Minister standing behind a lectern, flanked by Australian flags. But unlike previous press conferences, she was joined by Treasurer Wayne Swan and Climate Change Minister Greg Combet.

Under the collective gaze of the nation, Ms Gillard began the speech that would be the start of either a springboard to magnificent political success or a long death-march to the next election. Read more…

Frank Jotzo, Director of the Centre for Climate Economics and Policy at ANU, went into the carbon tax lock-up for us, and wrapped up the scheme in a clear, concise and insightful piece.

Two years ago Australian climate policy looked dead. Now we are on the verge of legislation that puts a carbon price through much of the Australian economy, alongside new schemes to support renewable energy, improve energy efficiency and increase carbon sequestration on the land.

Although the carbon pricing scheme has its warts, the negotiations between Labor, the Greens and the Independents have also produced some genuinely positive outcomes. The package will not bring big reductions in emissions in the short term, but it can be the first step on the long road to a lower-carbon economy. Read more…

Ten of the nation’s best-informed economists give their first impressions of the tax package.

Dr Ben McNeil, Senior Fellow, Climate Change Research Centre, University of New South Wales - Generally, what we needed to see was something which was a good starting price, a price that could be effective and manage the transition from what we do today to what we want to do in the future. The government’s really nailed it.

Professor Warwick McKibbin, Director, Research School of Economics, Australian National University - It’s broadly consistent philosophically with what I have been arguing for 20 years. I support the principles involved but there are some problems in detail. Read more…

Peter Christoff from the University of Melbourne asks if the climate has been forgotten in all the talk of a carbon tax.

As the old saying goes, “the road to Hell is paved with good intentions”. On Sunday, the exhausting, almost decade-long battle to put a price on carbon pollution enters a new phase, when the MultiParty Climate Committee formally releases its recommendations for a carbon tax.

With the Greens in control of the Senate, the tax is likely to pass into law later this year and be in place by mid-2012, on track to an emissions trading scheme by 2015. This first step is, without a doubt, welcome and long-overdue. Read more…

Will Grant from the ANU talks to climate scientist Will Steffen about the science behind the carbon tax, and the importance of communication.

Grant You’ve been talking about climate science for the last many years. Today we’d like to talk about something different: where the communication of climate science is up to, and getting your feel on what’s going on.

Steffen One of the things that I’ve noticed, and that I’ve really enjoyed in my role as a Climate Commissioner (which is a fairly recent one), is going from the idea of communication to the idea of engagement. Read more…

*David Pannell from the University of Western Australia explains the difference between a carbon tax and a trading scheme, and why our tax is more like an ETS. *

The proposed carbon pricing policy in Australia is now routinely referred to as a “carbon tax” by both government and opposition.

This is odd, because the proposed scheme is not actually a tax. Read more…